26+ Missouri Income Calculator

Web Simply enter your taxable income filing status and the state you reside in to find out how much you can expect to pay. Web Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4.

Inline Xbrl Viewer

Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Missouri.

. Calculate your Missouri tax using the online tax calculator at httpsdormogovpersonalindividual or by using the worksheet in Section B below. Pay frequency Additional withholdings. Web Use our income tax calculator to find out what your take home pay will be in Missouri for the tax year.

However Missouri also has certain deductions that can reduce your taxes. Web You can quote life insurance online. Web Calculate your Missouri tax using the online tax calculator at dormogovpersonalindividual or by using the worksheet in Section B below.

Enter your info to see your take home pay. Web Use Missouri Paycheck Calculator to estimate net or take home pay for salaried employees. Web No more than four credits can be earned per year and the income amount required to earn a single credit changes annually based on general wage levels.

Line references from each Missouri tax form are provided below. State Filing status Self-employed. Web Missouri Income Tax Calculator Estimate your Missouri income tax burden Updated for 2023 tax year on Jul 18 2023 What was updated.

Your actual tax liability will depend on your specific tax situation. The rates range from 0 up to 53 for the 2022 tax year. Web Double check your tax calculation.

All you have to do is answer some questions and fill in the details of your desired policy including your coverage amount and policy type. Web Missouri Paycheck Calculator Calculate your take-home pay after federal Missouri taxes Updated for 2023 tax year on Sep 19 2023 What was updated. Web A Missouri income tax calculator can help you determine your tax liability in the state.

Enter your info to see your take home pay. For example taxpayers with government pensions can deduct up to 6000 from their state income. Missouris personal income tax is structured in a similar manner to the federal income tax with marginal rates based on each taxpayers level of income.

Enter the taxable income from your tax form and we will calculate your tax for you. Web Use ADPs Missouri Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Well do the math for youall you need to do is enter the applicable information on salary federal and state W.

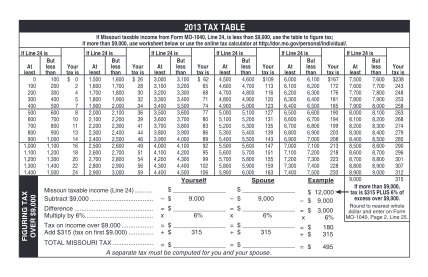

Web SmartAssets Missouri paycheck calculator shows your hourly and salary income after federal state and local taxes. Tax Rate Chart If the Missouri taxable income is. Web SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. Web To use our Missouri Salary Tax Calculator all you need to do is enter the necessary details and click on the Calculate button. Accuracy of the estimate will depend on the accuracy of your input.

Web New to Missouri Tax Calculators Home Calculators Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes. Web Enter your employment income into the paycheck calculator above to estimate how taxes in Missouri USA may affect your finances. Web Missouri Income Taxes.

Youll then get your estimated take home pay an estimated breakdown of your potential tax liability and a quick summary down here so you can have a better idea of what to possibly expect when. Web The Missouri Salary Calculator is a good tool for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2024 and Missouri State Income Tax Rates and Thresholds in 2024. Annual income Tax year State City Filing status Self-employed.

Enter your details to estimate your salary after tax. Tax Professionals can use the calculator when testing new tax software or assisting with tax planning. Joint and single filers pay the same rates.

Switch to salary calculator Missouri paycheck FAQs Missouri payroll State Date State Missouri. Use our paycheck tax calculator. This Missouri hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Employers can use the calculator rather than manually looking up withholding tax in tables. Web Individual Income Tax Calculator. You can also call 1-866-912-2477 to speak with a licensed Progressive Life by eFinancial representative who can help you find the right policy for your needs.

Additions to Tax and Interest Calculator Income. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. A separate tax must be computed for you and your spouse.

Simply input salary details benefits and deductions and any other necessary information as prompted below and let our tool handle the rest. Tax year Job type Salaryhourly wage Overtime pay. 401 k contribution IRA contribution Deductions Total income taxes 000 NaN of gross income Total federal income tax.

The income tax rates in Missouri are based on the federal adjusted gross income AGI. Web Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Missouri paycheck calculator. Web To identify your tax use your Missouri taxable income from Form MO-1040 Line 26Y and 26S and the tax chart in Section A below.

Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Web Missouri Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck. Generally if your taxable income is below the 2022-2023 standard deduction.

The income threshold is 1640 in 2023 up. Check this handy tax calculator for an estimate of your Missouri tax liability. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Round to the nearest whole dollar and enter on Form MO-1040 Line 28Y and 28S.

Remote Rails Jobs With Great Benefits And Pay

Fire Marshal Salary In Missouri Hourly Rate Oct 2023

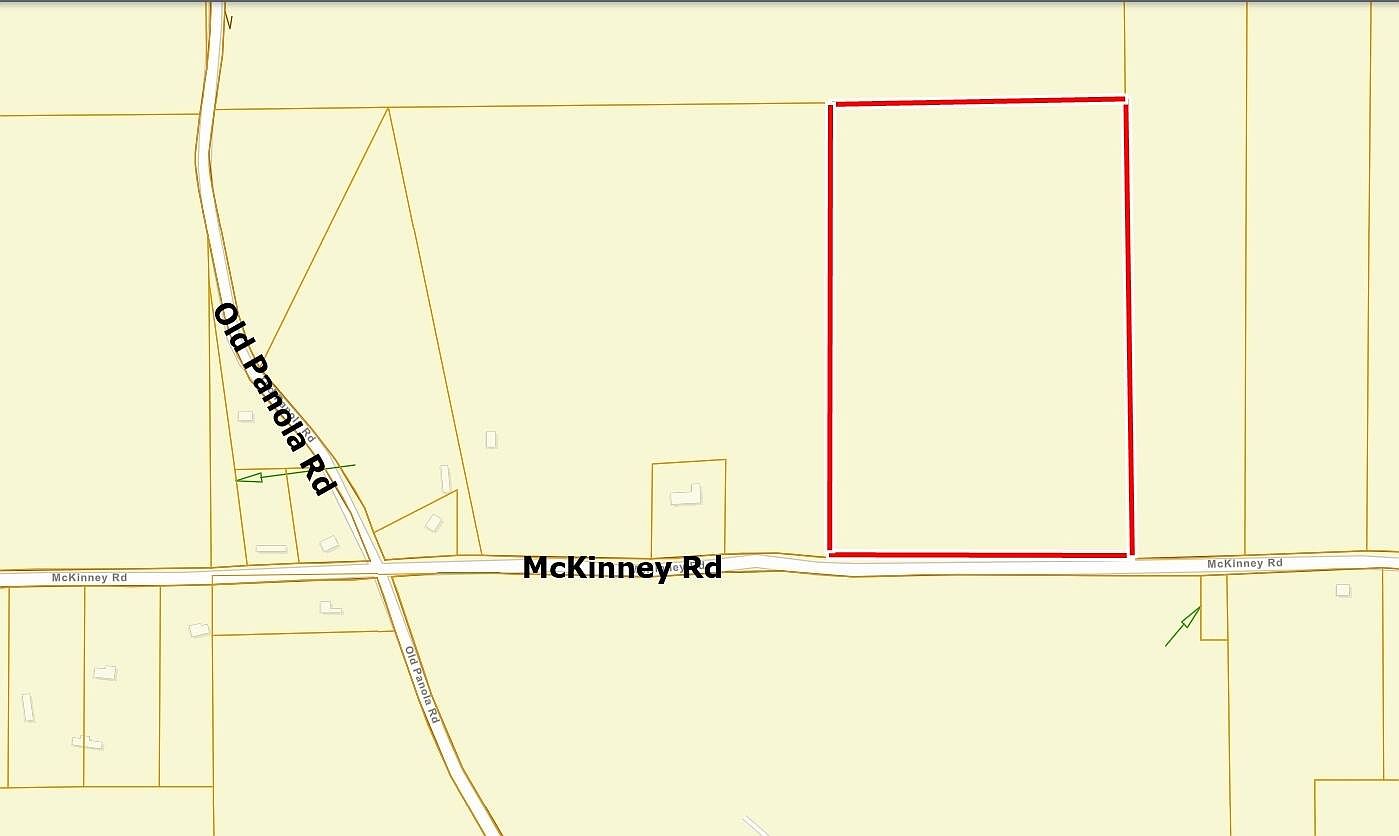

Mckinney Rd Sardis Ms 38666 Mls 22 2891 Zillow

Dust Bowl Migrants Environmental Refugees And Economic Adaptation The Journal Of Economic History Cambridge Core

Remote Rails Jobs With Great Benefits And Pay

Intersections Identities A Radical Rethinking Of Our Transportation Experiences By Apa Tpd Sotp Issuu

Missouri Income Tax Calculator Smartasset

Politifact Gubernatorial Candidate Exaggerates Missouri Tax Brackets

Paycheck Calculator Take Home Pay Calculator

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

Tdt4310 Project Finnum Training Rebuilded Csv At Master Pthoang Tdt4310 Project Github

Missouri State Tax Calculator 2023 2024

2023 Reserve And National Guard Drill Pay 4 6 Increase

Monthly Expense Report 11 Examples Format Pdf Examples

Missouri Paycheck Calculator 2023 Investomatica

Mathematics For Business Science And Technology Pdf

Missouri Sales Tax Calculator Reverse Sales 2023 Dremployee